15

2025

-

03

Chinese shipyards are overwhelmed with orders, leading to significant profits for South Korean engine manufacturers!

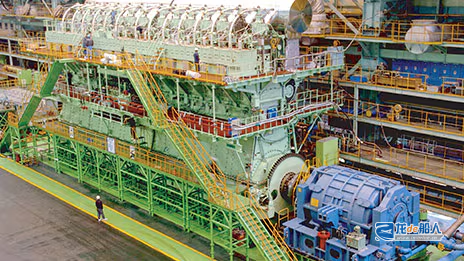

With the booming global shipbuilding industry, South Korean marine engine manufacturers are increasing investment and expanding production facilities to meet the continuous demand for orders.

Hanwha Engine has signed marine engine supply contracts worth approximately 845.2 billion KRW (approximately 4.2 billion RMB) in the past two months. This amount has reached half of last year's record annual order value of 1.65 trillion KRW (approximately 8.2 billion RMB).

Following a 629.2 billion KRW marine engine order in January, Hanwha Engine received another engine supply contract worth 216 billion KRW on February 5th. Although the client is only identified as an Asian client,industry insiders generally speculate that it is an order from a Chinese shipyard. Given that the shipbuilding orders from Chinese shipyards are already scheduled until 2029, more engine orders are expected to pour in in the future.。

To cope with the surge in orders, Hanwha Engine recently decided to invest in new facilities to expand production capacity. The company plans to invest 80.2 billion KRW in its Changwon factory by next September to further enhance its production capacity. Since the acquisition of HSD Engine in 2023, Hanwha Engine has continued to expand its production capacity of dual-fuel engines. Currently, its annual engine production capacity is approximately 130 units, and it will focus on improving the production capacity of large dual-fuel engines in the future.

Meanwhile, HD Korean Shipbuilding & Offshore Engineering (HD KSOE) is restructuring its engine business.Since the completion of the acquisition of former STX Heavy Industries (now HD Hyundai Marine Engine) in July last year,HD KSOE has transferred its medium-sized engine business to a subsidiary. HD Hyundai Heavy Industries will focus on the production of large engines, while HD Hyundai Marine Engine will be responsible for supplying medium-sized engines to HD Hyundai Ulsan.

HD Hyundai Marine Engine is currently accelerating the restoration of its operating rate through investment in facilities and equipment upgrades. The company plans to gradually increase its current operating rate of 40% to 100%. In January of this year, the company also successfully secured a 37.2 billion KRW marine engine supply contract from Samsung Heavy Industries.

South Korean engine manufacturers are actively deploying in the field of maintenance and repair services for environmentally friendly marine engines. With the continuous growth in demand for environmentally friendly dual-fuel engines, long-term service agreements (LTSA) have become a new source of revenue growth. At the end of last month, Hanwha Engine signed a 19.6 billion KRW LTSA contract with domestic shipping company Pan Ocean, involving five years of maintenance and repair work for 27 of Pan Ocean's marine engines.

This is the first LTSA contract Hanwha Engine has secured since its independence from HSD Engine in February last year.Hanwha GroupThrough the acquisition of HSD Engine, it has made comprehensive investments in personnel and facilities and officially entered the marine engine LTSA business. With the increasingly stringent global ship environmental regulations, the usage rate of dual-fuel engines that can use environmentally friendly fuels such as liquefied natural gas (LNG) and methanol has been continuously increasing, significantly increasing the demand for the LTSA market.

A representative from Hanwha Engine stated: “We have confirmed the market demand for LTSA services. For a long time, ship owners have been accustomed to diesel engines and are relatively unfamiliar with the management of dual-fuel engines, which is challenging. We plan to actively Enter this market and provide professional support to our customers.”

Key words:

Other dynamics